Unleash the power of the business inventory exemption, the secret weapon that can transform your tax bill into a work of art! Get ready to dive into a world where numbers dance and tax savings become a reality. Hold on tight, folks, because this journey is about to get wild and informative!

In the realm of taxation, there’s a magical exemption known as the business inventory exemption. It’s like a tax-saving superhero that swoops in to protect your precious inventory from the clutches of the taxman. But wait, there’s more! This exemption is not just for superheroes; it’s for all businesses, big and small.

Business Inventory Exemption Definition

Business inventory exemption is a legal provision that exempts certain types of property from taxation. This exemption is designed to encourage businesses to maintain an adequate inventory of goods, which can help to stimulate economic growth and create jobs.

The scope of the business inventory exemption varies from state to state. In general, however, the exemption applies to tangible personal property that is held for sale in the ordinary course of business. This includes raw materials, work in progress, and finished goods.

Purpose of the Exemption

The purpose of the business inventory exemption is to reduce the tax burden on businesses and encourage them to maintain an adequate inventory of goods. This can help to stimulate economic growth and create jobs.

Without the exemption, businesses would be taxed on the full value of their inventory. This would make it more expensive for businesses to maintain an adequate inventory, which could lead to shortages of goods and higher prices for consumers.

Scope of the Exemption

The scope of the business inventory exemption varies from state to state. In general, however, the exemption applies to tangible personal property that is held for sale in the ordinary course of business. This includes raw materials, work in progress, and finished goods.

Some states also exempt certain types of property that is not held for sale, such as machinery and equipment. Other states exempt only certain types of businesses, such as manufacturers or wholesalers.

Tax Implications of the Exemption

Buckle up, business owners! The business inventory exemption is your tax-saving superhero, here to reduce your tax liability and make you dance with joy.

Like a magician pulling a rabbit out of a hat, this exemption makes your inventory vanish from the taxable world. It’s like having a secret stash of untaxed goods, but without the risk of getting caught by the taxman.

Impact on Tax Liability

The impact of this exemption is like a gentle breeze on a warm summer day – it’s a breath of fresh air for your tax bill.

- Reduced Taxable Income:Since your inventory isn’t taxed, your taxable income takes a dive, reducing your overall tax burden.

- Lower Tax Payments:With a lower taxable income, you’ll end up paying less in taxes, leaving more money in your pocket to invest in your business or treat yourself to a well-deserved vacation.

So, if you’re a business owner with inventory, don’t let this exemption slip through your fingers. Embrace its tax-saving powers and watch your tax liability shrink like a shrinking violet.

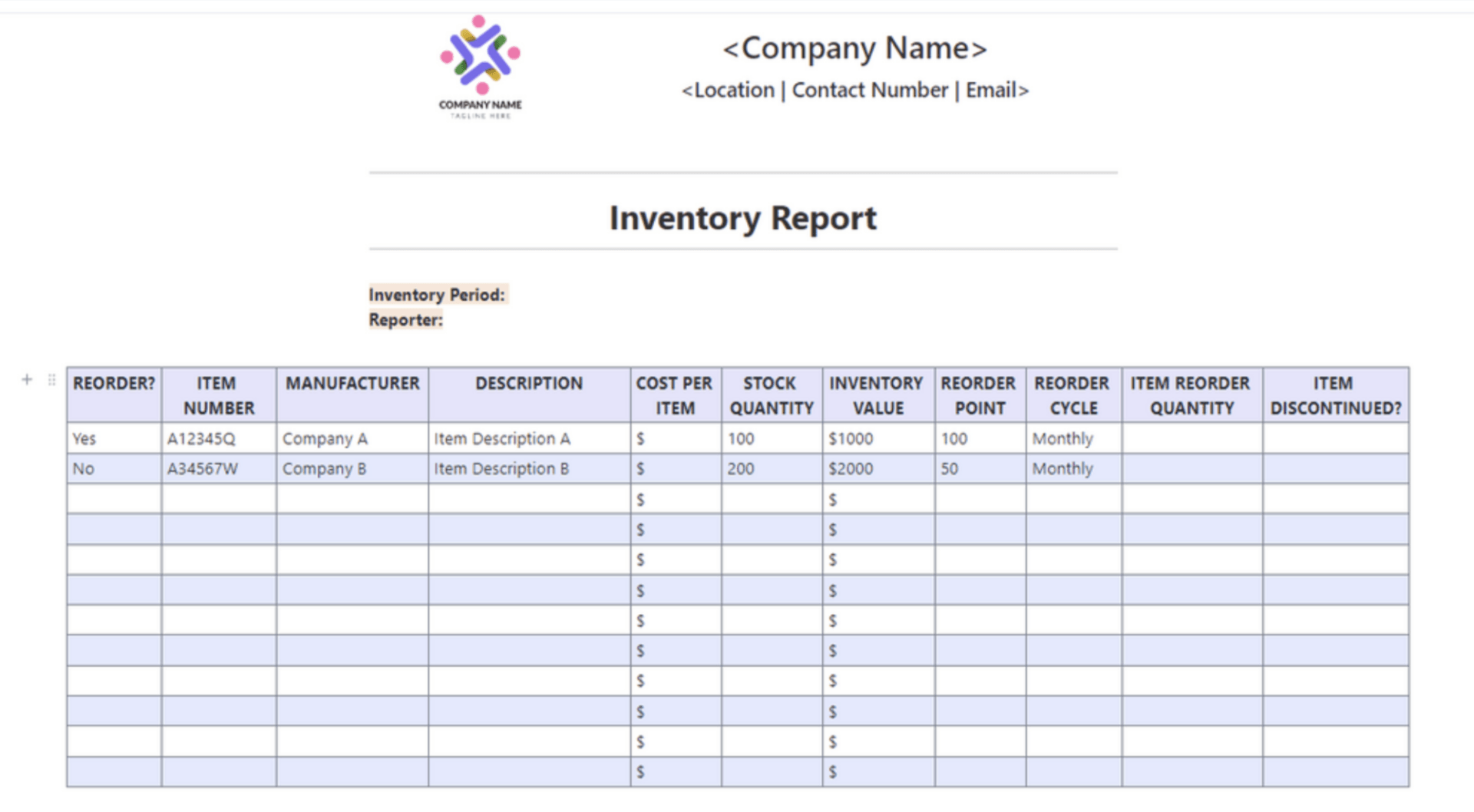

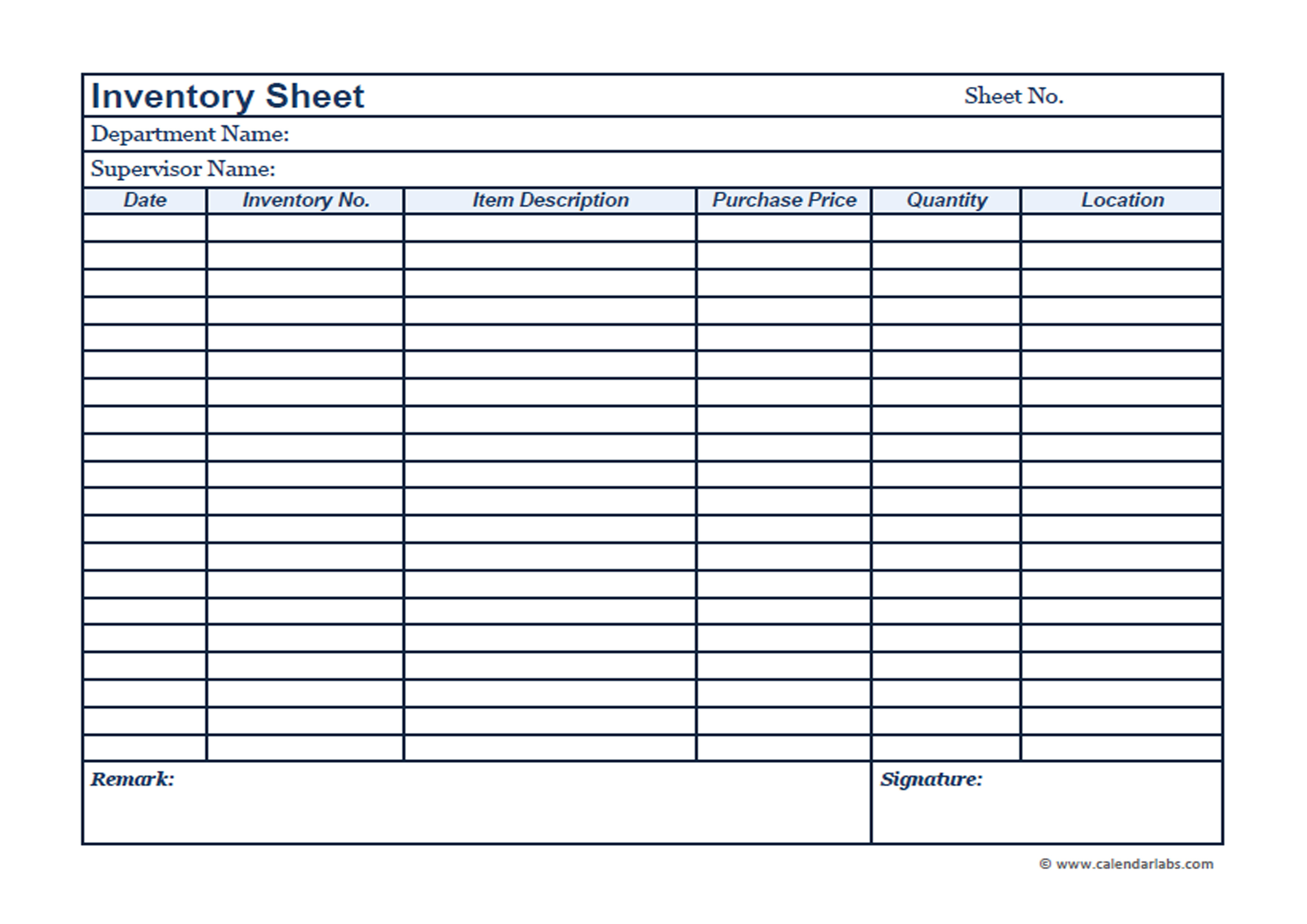

Record-Keeping Requirements

To keep the taxman at bay, businesses claiming the business inventory exemption must maintain meticulous records. It’s like being a detective, but instead of chasing down criminals, you’re tracking your inventory.

The records you need to keep are like a treasure map, providing a clear trail of your inventory’s whereabouts. They include:

Purchase Records

- Invoices or receipts for every inventory item purchased, like a grocery list for your business pantry.

- Proof of payment, like a bank statement or canceled check, showing you actually paid for the goods.

Sales Records

- Invoices or receipts for every inventory item sold, like a cash register tape of your business transactions.

- Records of any discounts or refunds given, like a record of your generosity or the occasional customer complaint.

Inventory Tracking

- Physical inventory counts, like taking stock of your shelves and closets.

- Inventory management systems or software, like a digital warehouse manager keeping track of every item.

These records are your secret weapon against tax audits. Keep them organized and up-to-date, and you’ll be able to prove your inventory exemption with the ease of a master magician pulling a rabbit out of a hat.

Common Misconceptions and Pitfalls

The business inventory exemption, while straightforward in concept, can trip up even the most seasoned business owners. Let’s debunk some common misconceptions and highlight potential pitfalls to help you steer clear of any inventory-related mishaps.

Misconception: All Inventory is Exempt, Business inventory exemption

Not so fast! The exemption applies only to inventory held for sale in the ordinary course of business. Items like office supplies, furniture, or equipment are not considered inventory and are subject to property tax.

Pitfall: Overestimating Inventory Value

Inflating your inventory value to reduce your tax bill is a tempting but risky move. Assessors have a keen eye for overvaluation, and you could end up paying more in penalties than you saved in taxes.

Keeping Accurate Records

Documentation is key when it comes to the business inventory exemption. Maintain detailed records of inventory purchases, sales, and usage to support your exemption claim. Remember, the burden of proof lies with you.

Pitfall: Incomplete or Inaccurate Records

Incomplete or inaccurate records can raise red flags and undermine your exemption claim. Ensure your records are up-to-date, organized, and accessible for inspection.

Final Summary

So, there you have it, the incredible business inventory exemption. Use it wisely, and you’ll be laughing all the way to the bank. Just remember, keeping accurate records is like having a superpower – it’ll save you from any tax-related kryptonite.

Now go forth, conquer your tax woes, and let the business inventory exemption be your trusty sidekick!

General Inquiries

What’s the catch? Are there any strings attached to this exemption?

Nope, no strings attached! As long as your inventory meets the eligibility criteria, you’re good to go.

Can I claim the exemption for my personal stash of comic books?

Sorry, but the exemption is strictly for business inventory. Your comic book collection, as awesome as it may be, doesn’t qualify.

What if I sell both taxable and non-taxable items? Can I still use the exemption?

Absolutely! You can use the exemption for your taxable inventory as long as you keep accurate records separating the two.