Business inventory fiscal year tax kentucky – Kentucky’s business inventory fiscal year tax plays a crucial role in shaping the tax obligations of businesses operating within the state. This comprehensive guide delves into the intricacies of this tax, providing an overview of its purpose, applicable fiscal year, taxable and exempt inventory items, tax calculation methods, reporting procedures, penalties for non-compliance, tax planning strategies, and recent legislative changes.

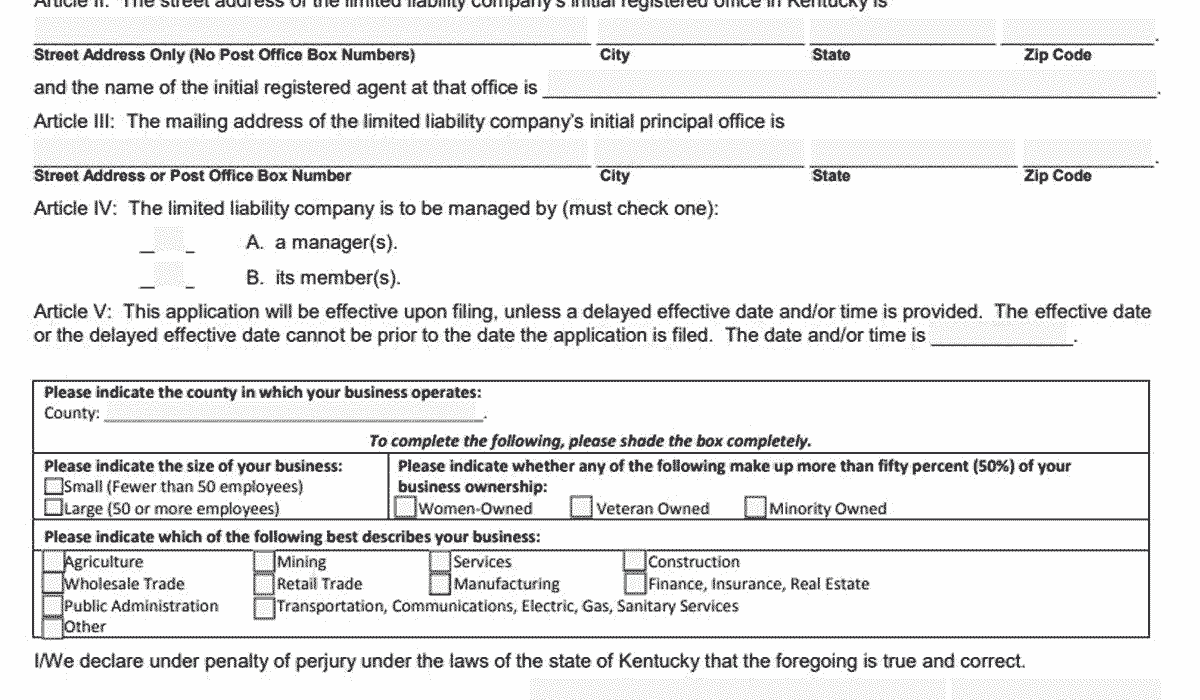

Tax Calculation and Reporting Procedures

The Kentucky business inventory tax is calculated based on the average value of inventory held during the taxable year. The average value is determined by taking the sum of the beginning and ending inventory values and dividing by two. The tax rate is 0.06%.

Tax Return Filing and Submission

Businesses are required to file and submit Kentucky business inventory tax returns annually. The returns are due on or before May 1st of the year following the taxable year. The returns must be filed with the Kentucky Department of Revenue.

The following documentation must be included with the return:

- A copy of the business’s federal income tax return

- A schedule of the business’s inventory

- A payment for the amount of tax due

Penalties and Compliance Measures

Non-compliance with the Kentucky business inventory tax can result in serious consequences, including penalties and interest charges. It is crucial for businesses to maintain accurate records and make timely tax payments to avoid legal issues.

Penalties

- Late Filing Penalty:Failure to file the business inventory tax return by the due date can result in a penalty of 10% of the tax due, with a minimum penalty of $50.

- Late Payment Penalty:Failure to pay the business inventory tax by the due date can result in a penalty of 10% of the tax due, with a minimum penalty of $50.

- Interest Charges:Interest will be charged on any unpaid business inventory tax at a rate of 12% per annum.

- Additional Penalties:In cases of fraud or willful neglect, the Kentucky Department of Revenue may impose additional penalties, including criminal charges.

Tax Planning and Strategies

Tax planning strategies can significantly reduce the impact of the Kentucky business inventory tax while maintaining business operations. Here are some key strategies:

Inventory Optimization

Optimizing inventory levels can minimize tax liability without compromising business efficiency. Strategies include:

Just-in-time (JIT) inventory management

Receiving inventory as close as possible to the time of production or sale reduces inventory holding costs and tax liability.

Consignment inventory

Holding inventory on a consignment basis means ownership is not transferred until the goods are sold, reducing taxable inventory value.

Inventory pooling

Combining inventory from multiple locations into a single pool allows for better management and reduces overall tax liability.

Tax Exemptions

Kentucky provides various tax exemptions that can reduce inventory tax liability:

Manufacturing exemption

Inventory used in manufacturing is exempt from taxation.

Agricultural exemption

Inventory related to agricultural production is exempt.

Nonprofit exemption

Nonprofit organizations are exempt from inventory tax.

Recent Updates and Legislative Changes

The Kentucky business inventory tax laws and regulations have undergone several recent changes and updates that businesses should be aware of. These changes impact the calculation, reporting, and compliance requirements for the tax.

One significant change is the increase in the inventory tax rate from 0.15% to 0.25%. This change took effect on January 1, 2023, and applies to all businesses with inventory subject to the tax.

Another notable change is the expansion of the definition of “inventory” to include certain items that were previously exempt. This change means that businesses may now be subject to the tax on a wider range of items.

Implications for Businesses

The recent changes to the Kentucky business inventory tax laws and regulations have several implications for businesses. The increase in the tax rate will result in higher tax liability for businesses with inventory subject to the tax.

The expanded definition of “inventory” may also lead to increased tax liability for businesses that were previously exempt from the tax on certain items.

Future Tax Planning Considerations, Business inventory fiscal year tax kentucky

Businesses should consider the implications of the recent changes to the Kentucky business inventory tax laws and regulations when planning for the future. Businesses may want to consider reducing their inventory levels to minimize their tax liability.

Businesses may also want to review their inventory accounting practices to ensure that they are accurately tracking all inventory items subject to the tax.

Outcome Summary: Business Inventory Fiscal Year Tax Kentucky

Understanding the Kentucky business inventory fiscal year tax is essential for businesses to ensure compliance, minimize tax liability, and maintain a competitive edge. This guide serves as a valuable resource for businesses navigating the complexities of this tax and making informed decisions that support their financial well-being.

Questions and Answers

What types of inventory are subject to the Kentucky business inventory tax?

Inventory items held for sale or lease in the ordinary course of business are generally subject to the tax.

Are there any exemptions to the Kentucky business inventory tax?

Yes, certain items such as raw materials, work-in-progress, and finished goods held for export are exempt from the tax.

How is the Kentucky business inventory tax calculated?

The tax is calculated as a percentage of the average value of inventory held during the fiscal year.

What are the penalties for non-compliance with the Kentucky business inventory tax?

Penalties may include fines, interest charges, and potential legal action.