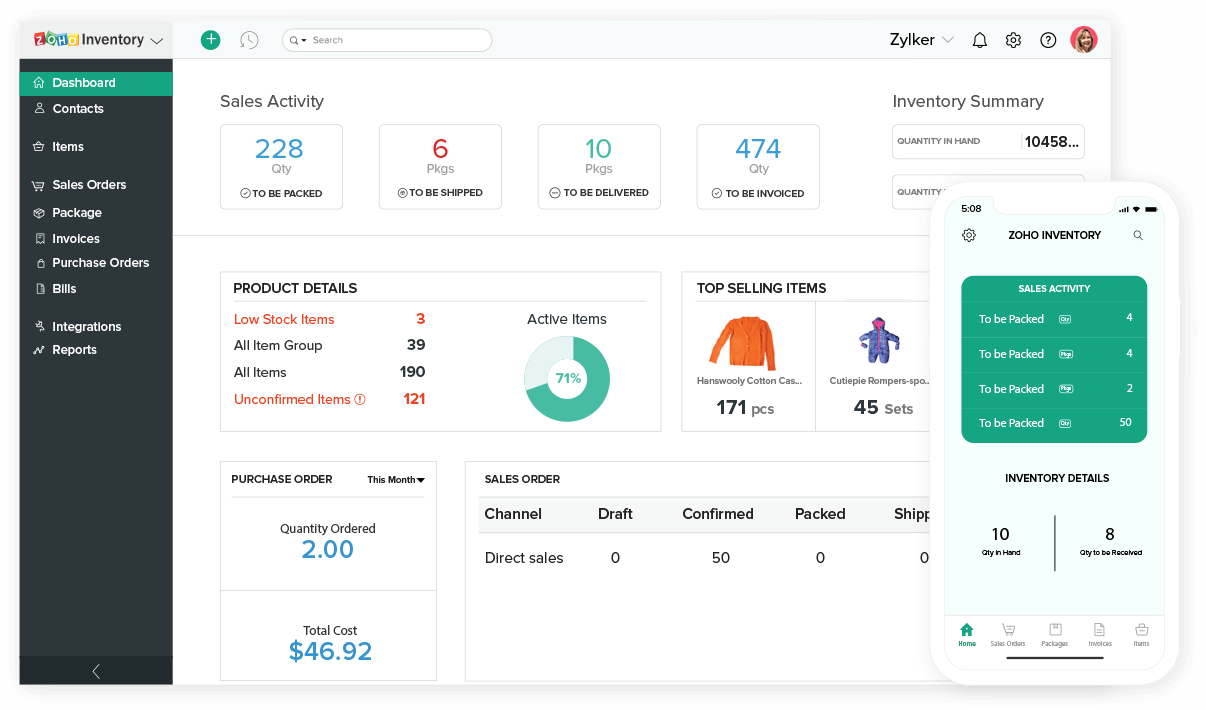

Introducing the transformative small business finance and inventory app, the key to unlocking financial clarity and streamlined inventory management. This innovative tool empowers small businesses to optimize their operations, maximize efficiency, and drive growth like never before.

With a user-friendly interface, real-time insights, and robust automation capabilities, this app revolutionizes the way small businesses manage their finances and inventory. Get ready to elevate your business to new heights with the ultimate solution for financial success.

Small Business Finance Management

Small business finance management is crucial for the success and stability of any small business. Managing finances effectively can help businesses make informed decisions, optimize cash flow, and achieve long-term growth. Utilizing a finance management app can significantly streamline and enhance these processes, providing numerous benefits to small businesses.

Finance management apps offer a comprehensive suite of features designed to cater to the specific needs of small businesses. These features typically include:

Features of Finance Management Apps

- Expense Tracking:Easily track and categorize business expenses, providing a clear overview of where funds are being allocated.

- Invoicing and Billing:Create and send professional invoices, track payments, and manage customer billing efficiently.

- Budgeting and Forecasting:Set financial goals, create budgets, and forecast future cash flow to ensure financial stability.

- Financial Reporting:Generate customized financial reports, such as income statements, balance sheets, and cash flow statements, for in-depth analysis and decision-making.

- Tax Management:Calculate and track taxes, generate tax reports, and stay compliant with tax regulations.

- Integration with Accounting Software:Seamlessly integrate with accounting software to automate data entry and streamline financial processes.

When choosing a finance management app for your small business, it’s essential to consider factors such as:

Tips for Choosing a Finance Management App

- Business Size and Complexity:Select an app that aligns with the scale and complexity of your business operations.

- Features and Functionality:Ensure the app offers the necessary features and functionality to meet your specific financial management needs.

- User Interface:Choose an app with an intuitive and user-friendly interface that simplifies financial management tasks.

- Integration Capabilities:Consider apps that integrate with your existing software and tools to enhance efficiency and streamline processes.

- Customer Support:Opt for apps that provide reliable customer support to assist with any queries or technical issues.

Inventory Management

Inventory management can be a complex and challenging task for small businesses. With limited resources and staff, it can be difficult to keep track of stock levels, manage orders, and prevent waste. Fortunately, inventory management apps can help businesses overcome these challenges by automating many of the tasks involved in inventory management.

Benefits of Inventory Management Apps

Inventory management apps offer a number of benefits for small businesses, including:

- Automated inventory tracking

- Improved order management

- Reduced waste

- Increased efficiency

- Better customer service

Integration and Automation: Small Business Finance And Inventory App

Integrating finance and inventory management systems is crucial for efficient business operations. It streamlines processes, enhances data accuracy, and provides real-time visibility into financial and inventory data.

Automating tasks through an integrated app further enhances efficiency and reduces manual errors. It can automate processes such as inventory tracking, order processing, invoicing, and financial reporting.

Comparison of Integration Capabilities

Different apps offer varying levels of integration capabilities. The following table compares some key features:

| App | Inventory Management | Financial Management | Data Synchronization | Reporting |

|---|---|---|---|---|

| App A | Comprehensive inventory tracking | Robust accounting features | Real-time data sync | Customizable reports |

| App B | Basic inventory tracking | Limited accounting capabilities | Manual data entry required | Predefined reports |

| App C | Advanced inventory management | Integration with third-party financial software | Automated data sync | Extensive reporting options |

Reporting and Analytics

Reporting and analytics are crucial for small businesses to monitor their financial health, track inventory levels, and make informed decisions. A finance and inventory app can empower businesses with robust reporting capabilities, providing valuable insights into their operations.

These apps generate various types of reports, including:

- Income statements:Summarize revenues, expenses, and profits over a specific period.

- Balance sheets:Provide a snapshot of assets, liabilities, and equity at a specific point in time.

- Cash flow statements:Track the flow of cash through the business.

- Inventory reports:Detail inventory levels, costs, and turnover rates.

Key Metrics to Track

The following key metrics can be tracked using the app’s reporting features:

- Gross profit margin

- Net profit margin

- Current ratio

- Inventory turnover ratio

- Days sales outstanding

Security and Data Protection

Protecting your financial and inventory data is paramount when using a finance and inventory app. Consider these security measures:

Encryption, Small business finance and inventory app

Ensure the app uses encryption to protect data at rest and in transit. This prevents unauthorized access, even if data is intercepted.

Multi-Factor Authentication

Implement multi-factor authentication (MFA) to add an extra layer of security. This requires users to provide multiple forms of identification, such as a password and a one-time code sent to their phone.

Data Backup and Recovery

Choose an app that offers data backup and recovery services. This ensures your data is safeguarded in case of hardware failure or data loss.

Data Privacy

Review the app’s privacy policy carefully. Understand how your data is collected, used, and shared. Ensure the app complies with industry regulations and protects your privacy.

Security Comparison

Compare the security features offered by different apps. Consider factors such as encryption methods, authentication protocols, and data backup options. Choose an app that meets your specific security requirements.

Ultimate Conclusion

In conclusion, the small business finance and inventory app is an indispensable tool for any business seeking to gain a competitive edge. Its comprehensive features, intuitive design, and powerful integration capabilities empower businesses to make informed decisions, optimize inventory levels, and achieve financial prosperity.

Embrace the future of business management and unlock the full potential of your small business today.

Quick FAQs

What are the key benefits of using a small business finance and inventory app?

Improved financial visibility, streamlined inventory management, automated tasks, enhanced reporting and analytics, and increased efficiency.

How can a small business finance and inventory app help businesses overcome inventory challenges?

By providing real-time inventory tracking, optimizing stock levels, automating reordering, and generating insights to improve decision-making.

What are some important security considerations when using a small business finance and inventory app?

Encryption, data protection measures, access controls, and regular security updates are crucial to safeguard sensitive financial and inventory information.