In the realm of home-based entrepreneurship, the home business inventory rider emerges as a crucial safeguard, protecting the very essence of your business – your inventory. Join us as we delve into the intricacies of this rider, unraveling its purpose, coverage, and significance in securing the lifeline of your home-based enterprise.

As a home business owner, you pour your heart and soul into acquiring and maintaining the inventory that fuels your operations. From raw materials to finished products, each item holds immense value, not just financially but also as a representation of your hard work and dedication.

However, unforeseen events such as fire, theft, or natural disasters can jeopardize your inventory, potentially crippling your business.

Definition and Purpose of Home Business Inventory Rider

A home business inventory rider is an optional endorsement to a homeowner’s insurance policy that provides coverage for business-related personal property used at home.

It protects items such as equipment, supplies, and inventory used in the operation of a home-based business. These items are typically not covered under standard homeowners’ insurance policies.

Covered Items

The following are examples of items typically covered by a home business inventory rider:

- Office equipment (e.g., computers, printers, scanners)

- Supplies (e.g., paper, ink, toner)

- Inventory (e.g., products for sale, raw materials)

- Furniture and fixtures

- Tools and equipment

Documentation and Valuation

Proper documentation and valuation of home business inventory are crucial for insurance purposes. Maintaining accurate records is essential for ensuring fair compensation in the event of a covered loss.

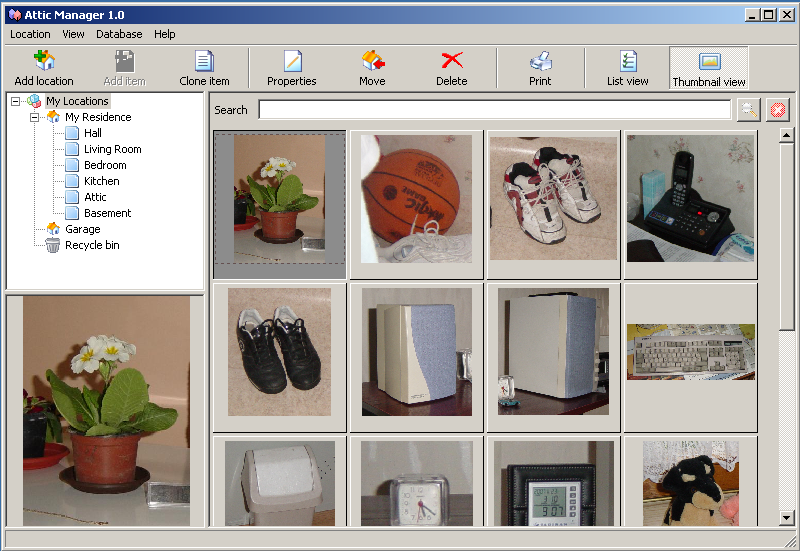

Inventory Documentation

- Physical Inventory:Conduct regular physical counts of your inventory, verifying the quantity and condition of each item.

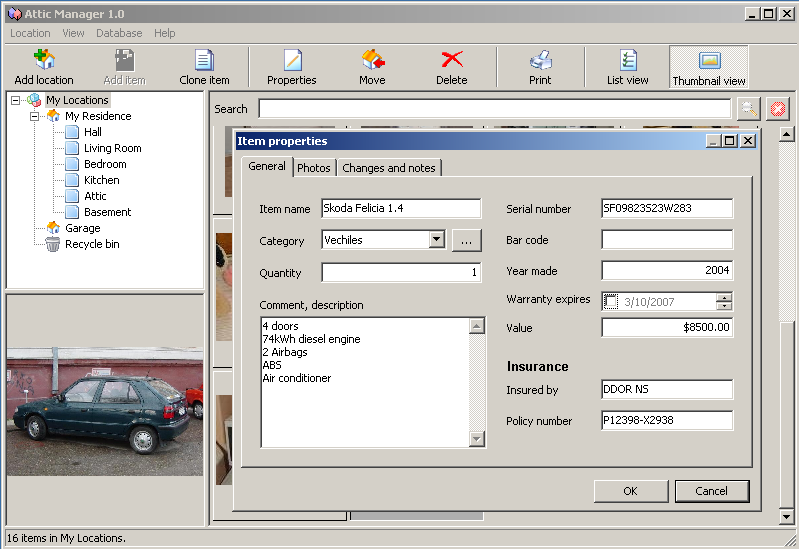

- Inventory List:Create a detailed inventory list that includes descriptions, serial numbers, purchase dates, and costs for each item.

- Photos and Videos:Take photos or videos of your inventory for documentation purposes.

Inventory Valuation

- Replacement Cost:The cost to replace an item with a similar one of like kind and quality.

- Actual Cash Value:The fair market value of an item, taking into account its age, condition, and depreciation.

- Agreed Value:A specific value agreed upon between you and the insurance company for certain high-value items.

Accurate records are essential for supporting your insurance claim.

Claims Process

Filing a claim under a home business inventory rider typically involves the following steps:

1. Notify the insurance company:Promptly report the loss or damage to your insurance company. Provide details of the incident, including the date, time, and cause of loss.

2. Submit a claim form:The insurance company will provide you with a claim form that you need to complete and submit. The form will ask for information about the damaged or lost property, its value, and the circumstances of the loss.

3. Provide documentation:You will need to provide documentation to support your claim. This may include receipts, invoices, or other proof of ownership and value of the damaged or lost property. You may also need to provide photographs or videos of the damage.

4. Insurance company investigation:The insurance company will investigate your claim to determine the cause of loss and the extent of the damage. They may send an adjuster to inspect the damaged property and assess the value of the loss.

5. Claims settlement:Once the insurance company has completed its investigation, they will determine the amount of your claim settlement. The settlement amount will be based on the terms of your policy, the value of the damaged or lost property, and the cause of loss.

Additional Considerations

When purchasing a home business inventory rider, consider factors such as:

Coverage limits

Determine the maximum amount of coverage you need for your inventory.

Deductible

Choose a deductible that balances affordability with coverage adequacy.

Exclusions

Understand what items are not covered by the rider.

Replacement cost vs. actual cash value

Replacement cost coverage pays for the cost of replacing damaged or lost inventory, while actual cash value coverage pays only the depreciated value.

Cost and Benefits, Home business inventory rider

The cost of a home business inventory rider varies based on factors like coverage limits and deductibles. However, it can provide valuable benefits, including:

Financial protection

In case of damage or loss, the rider ensures you can recover the value of your inventory.

Peace of mind

Knowing your inventory is protected can reduce stress and anxiety in case of an unexpected event.

End of Discussion

In conclusion, the home business inventory rider stands as an indispensable tool for safeguarding the foundation of your home-based enterprise. By carefully considering your coverage needs, documenting your inventory meticulously, and understanding the claims process, you can ensure that your business remains resilient in the face of unexpected challenges.

Embrace the peace of mind that comes with knowing your inventory is protected, allowing you to focus on growing your business with confidence and determination.

Quick FAQs

What items are typically covered by a home business inventory rider?

The rider typically covers raw materials, work-in-progress, finished goods, and supplies used in your home-based business.

Are there any exclusions to the coverage provided by the rider?

Yes, common exclusions include cash, securities, animals, and vehicles.

How do I determine the appropriate coverage limit for my home business inventory?

To determine the coverage limit, consider the total value of your inventory, including raw materials, work-in-progress, and finished goods.

What documentation is required to support a claim under the rider?

To support a claim, you will need to provide proof of ownership, such as invoices or receipts, and documentation of the value of the lost or damaged inventory.