Small business inventory purchased prior years can have a significant impact on current inventory levels, tax implications, and financial reporting. Understanding how to manage this inventory effectively is crucial for small businesses to optimize their operations and minimize losses.

This comprehensive guide delves into the complexities of small business inventory purchased prior years, providing insights into its impact, tax implications, and best practices for management. We’ll explore real-world case studies, discuss innovative inventory management solutions, and identify key factors that contribute to successful inventory management.

Tax Implications

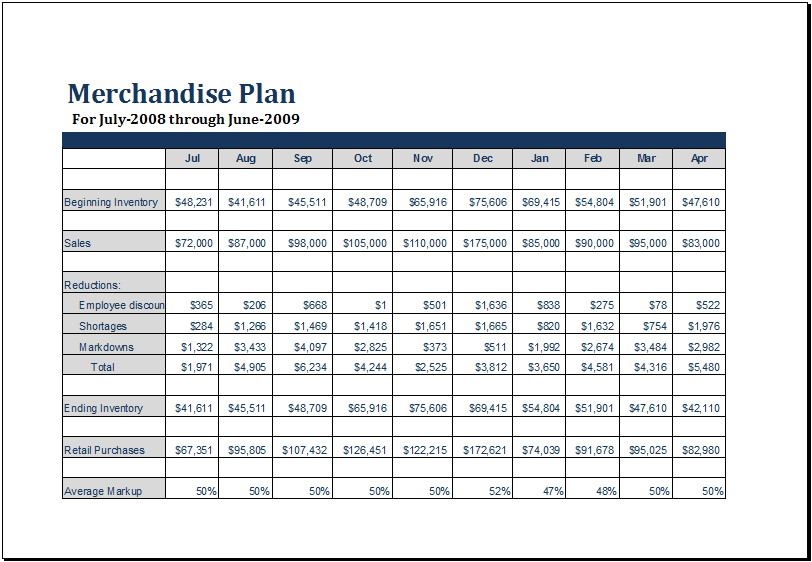

Understanding the tax implications of holding small business inventory purchased in prior years is crucial for accurate financial reporting and tax compliance. Two primary accounting methods, FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), impact how inventory is valued and subsequently affects taxable income.

The choice between FIFO and LIFO can significantly alter a company’s tax liability. FIFO assumes that the oldest inventory is sold first, while LIFO assumes that the most recently acquired inventory is sold first.

FIFO Method

- Under FIFO, the cost of goods sold is based on the cost of the oldest inventory on hand.

- This method results in a higher cost of goods sold during periods of rising prices, leading to lower taxable income and potentially lower tax liability.

- In periods of falling prices, FIFO results in a lower cost of goods sold and higher taxable income.

LIFO Method, Small business inventory purchased prior years

- LIFO assumes that the most recently acquired inventory is sold first.

- This method leads to a lower cost of goods sold during periods of rising prices, resulting in higher taxable income and potentially higher tax liability.

- Conversely, in periods of falling prices, LIFO results in a higher cost of goods sold and lower taxable income.

| Method | Rising Prices | Falling Prices |

|---|---|---|

| FIFO | Lower taxable income | Higher taxable income |

| LIFO | Higher taxable income | Lower taxable income |

Inventory Management Strategies

Maintaining inventory levels for items purchased in prior years is essential for optimizing storage space, minimizing waste, and maximizing profits. Implement robust inventory management strategies to ensure efficient inventory control.

Effective inventory management involves tracking inventory levels, forecasting demand, and optimizing storage and ordering processes. Here are some best practices to consider:

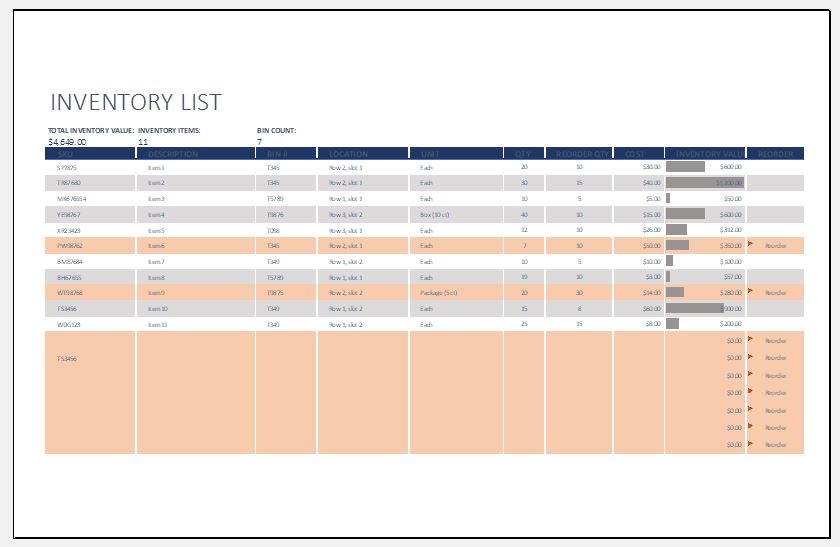

Inventory Tracking Software

Implement inventory tracking software to automate inventory management processes. These tools provide real-time inventory visibility, allowing you to monitor stock levels, track item movements, and generate reports for analysis.

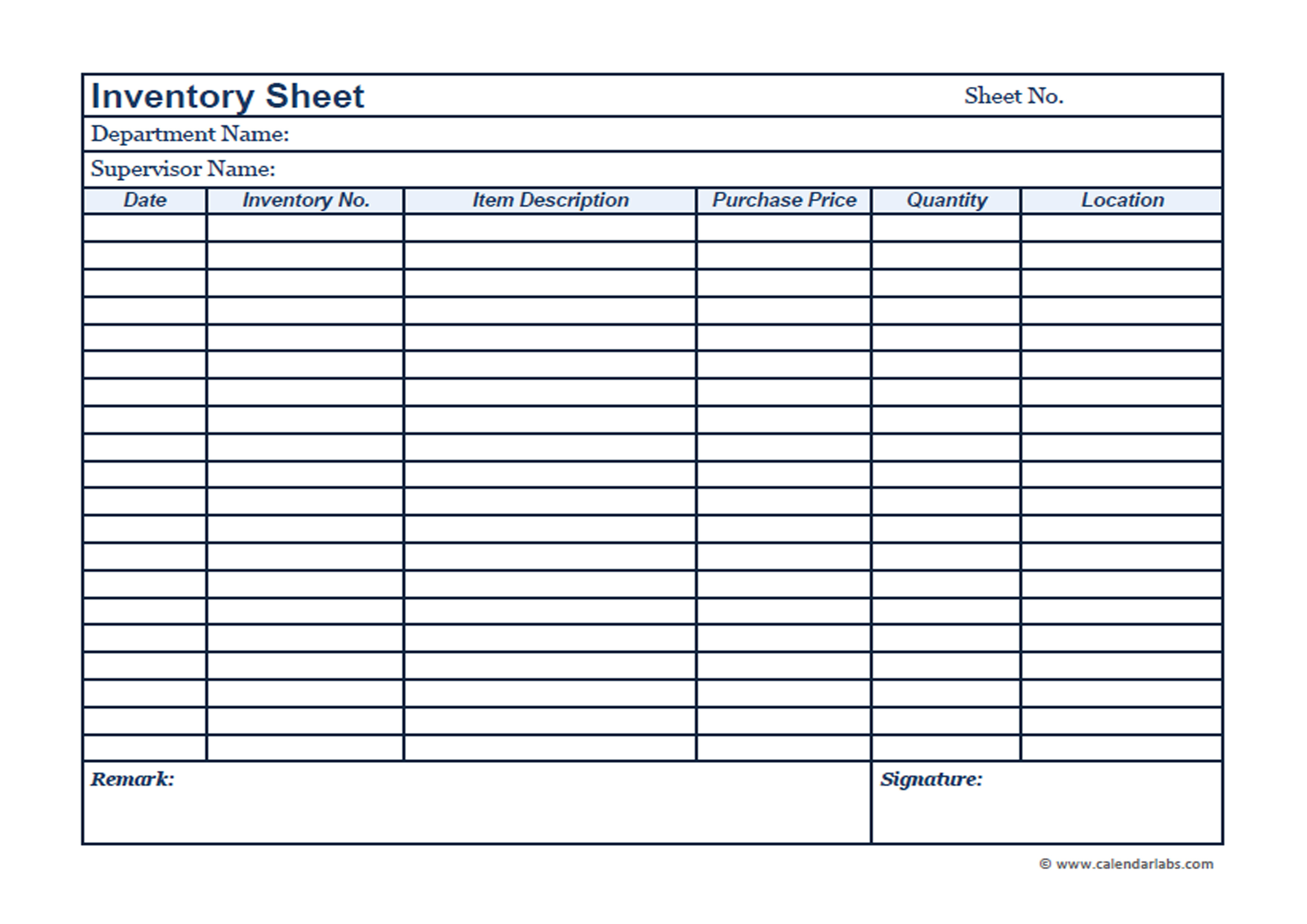

Periodic Inventory Counts

Conduct periodic physical inventory counts to verify the accuracy of your inventory records. This helps identify discrepancies between actual and recorded inventory levels, reducing the risk of stockouts or overstocking.

Vendor Relationships

Establish strong relationships with vendors to ensure timely delivery and competitive pricing. Consider negotiating bulk discounts or extended payment terms to optimize inventory costs.

Inventory Management Checklist

Follow this checklist to optimize inventory levels:

- Implement inventory tracking software.

- Conduct regular inventory counts.

- Establish strong vendor relationships.

- Forecast demand based on historical data.

- Set safety stock levels to prevent stockouts.

- Use inventory optimization techniques to minimize carrying costs.

- Regularly review and adjust inventory levels based on demand patterns.

Case Studies

Small businesses have successfully managed inventory purchased in prior years through innovative inventory management solutions. Analyzing their strategies provides valuable lessons for others.

Innovative Inventory Management Solutions

- Automated Inventory Management Systems:These systems track inventory levels, automate reordering, and provide real-time visibility into inventory status.

- Vendor Managed Inventory (VMI):Suppliers manage inventory levels at the customer’s site, ensuring optimal stock levels and reducing waste.

- Just-in-Time (JIT) Inventory:Businesses only order inventory when it is needed for production, minimizing storage costs and reducing obsolescence.

Factors Contributing to Success

Successful inventory management requires:

- Accurate Forecasting:Predicting demand accurately helps businesses avoid overstocking or understocking.

- Efficient Warehouse Management:Optimizing warehouse space and processes improves inventory turnover and reduces storage costs.

- Strong Supplier Relationships:Collaboration with suppliers ensures reliable deliveries and minimizes inventory disruptions.

Summary

In conclusion, managing small business inventory purchased prior years requires a strategic approach that considers the impact on current inventory, tax implications, and financial reporting. By implementing effective inventory management strategies, small businesses can optimize inventory levels, minimize losses, and enhance their overall financial performance.

FAQs: Small Business Inventory Purchased Prior Years

What is the impact of small business inventory purchased prior years on current inventory levels?

Aging inventory can lead to increased storage costs, reduced product quality, and decreased sales due to outdated or obsolete products.

What are the tax implications of holding small business inventory purchased prior years?

FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) accounting methods have different tax implications, affecting the cost of goods sold and taxable income.

How should small businesses disclose inventory purchased in prior years on their financial statements?

GAAP requires businesses to disclose prior year inventory separately on their financial statements, providing transparency and accuracy in financial reporting.